Investment in new fund Nextgen Ventures for accelerating healthcare innovations

13 januari 2026

September 13, 2023

2 minutes

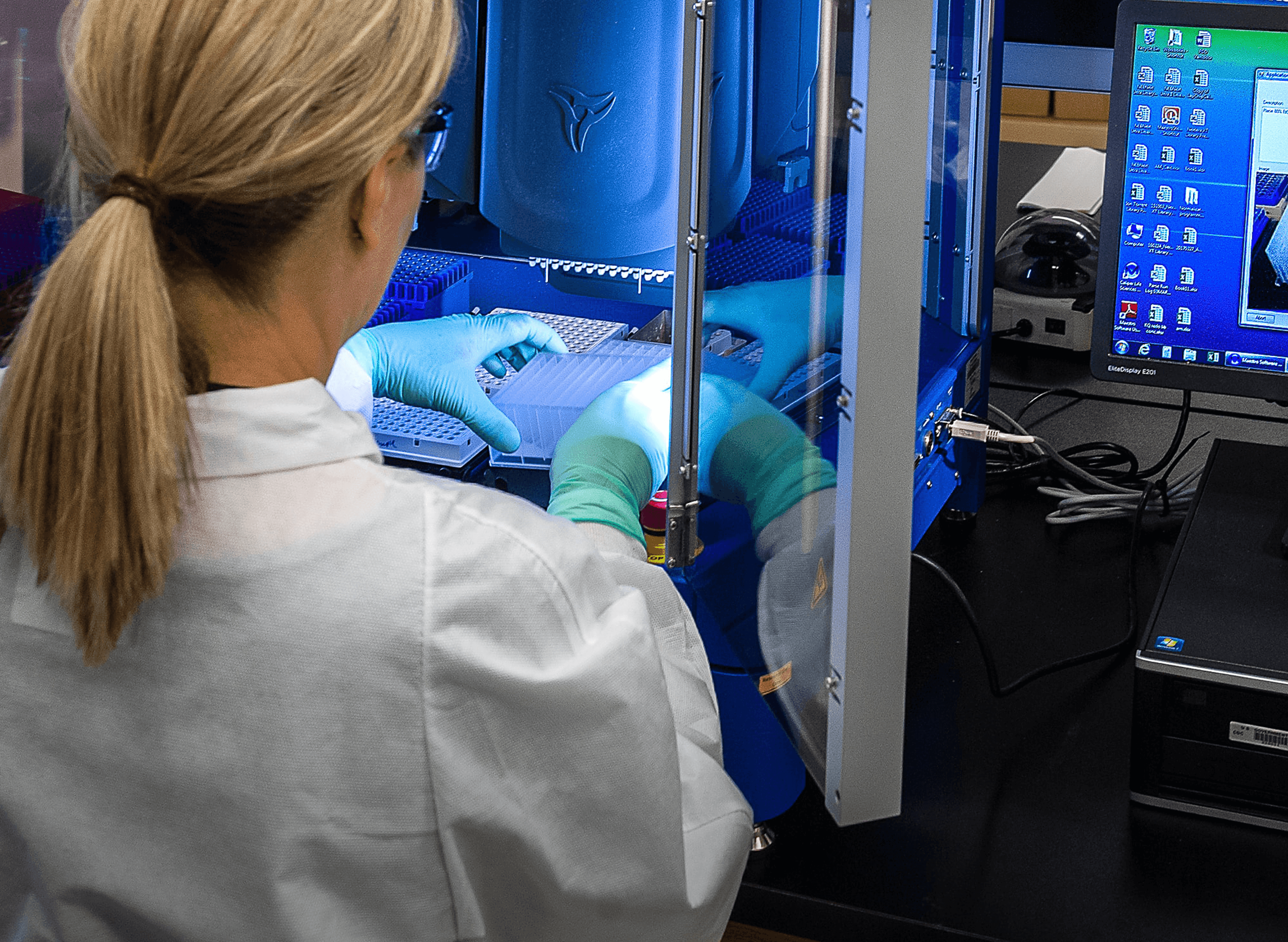

A unique collaboration between Philips, HighTechXL, the Brabantse Ontwikkelings Maatschappij (BOM), DeepTechXL and the Deep Tech Fund of impact investor Invest-NL has launched the new venture building program HealthTechXL.

This program is aimed at startups in the healthcare and MedTech sector. With HealthTechXL, the partners aim to stimulate the creation, construction and development of advanced medical technology in the Brainport Eindhoven region. Philips contributes by making intellectual property available and supporting talent through spin-outs from the reorganization, while HighTechXL and BOM supervise the program. Invest-NL intends to invest € 10 million through the Deep Tech Fund in promising ventures that emerge from the program.

HealthTechXL officially started at the beginning of September with 50 participants. In the first half of 2024, the participating teams will pitch their proposals to investors, potential partners and the broader Brainport startup community. The participants in HealthTechXL will further develop their ideas from concept phase to market introduction. They do this under the guidance of HighTechXL and BOM, who support them in both the establishment and further development of their startups. Successful participation in HealthTechXL can lead to investments from BOM, DeepTechXL and Invest-NL's Deep Tech Fund. Up to 15 startups are expected to receive funding in the next three years. This should eventually result in more companies contributing to better and more financially accessible healthcare, with Brainport Eindhoven as a catalyst for this development with a possible global impact.

Yvonne Greeuw, investment associate of the Invest-NL Deep Tech Fund: “There is enormous potential in the innovations that are currently untapped, as well as in the technical talent that becomes available to develop them further. These projects can play an important role in achieving better, affordable and accessible healthcare. However, they require patient capital and are often riskier than what regular investors typically look for. We are therefore pleased that we can offer financial perspective within this program with the Deep Tech Fund.”

Yvonne Greeuw

sr. investment manager