New legal toolkit helps companies set up energy hubs with GTO

26 januari 2026

October 20, 2025

3 minutes

The energy transition at sea is under pressure. Rising costs, lagging demand, and postponed tenders create uncertainty among developers and investors. To break this deadlock, the Ministry of Climate and Green Growth is exploring 'Contracts for Difference' (CfD): a price mechanism designed to provide more certainty to financiers and investors of offshore wind farms. During a Financing Table, Invest-NL, together with the Ministry of KGG, gathered insights from financiers and investors regarding the design choices of CfDs.

The cabinet presented the ‘Wind on Sea action plan’ on 16 September, containing measures in the areas of supply stimulation, demand development, and grid congestion, which a subsequent cabinet can swiftly act upon. Contracts for Difference may play an important role in supply stimulation of offshore wind energy from 2027 onwards. At the request of the Ministry of Climate and Green Growth, Invest-NL has voiced the perspective of the financial sector during the Financing Table Wind on Sea.

As a connector between government, market, and financiers, we brought together representatives from banks, institutional investors, and advisors to discuss the key design choices of CfDs together with the ministry.

A Contract for Difference is an agreement between the government and an energy producer. It guarantees a power price within a floor (the lowest point) and a cap (the highest point). If the market price falls below the floor, the government pays the difference. If the price exceeds the cap, the producer pays the surplus back to the government. This provides certainty about the expected revenue, reducing the financing risk and making the financing of offshore wind farms more attractive.

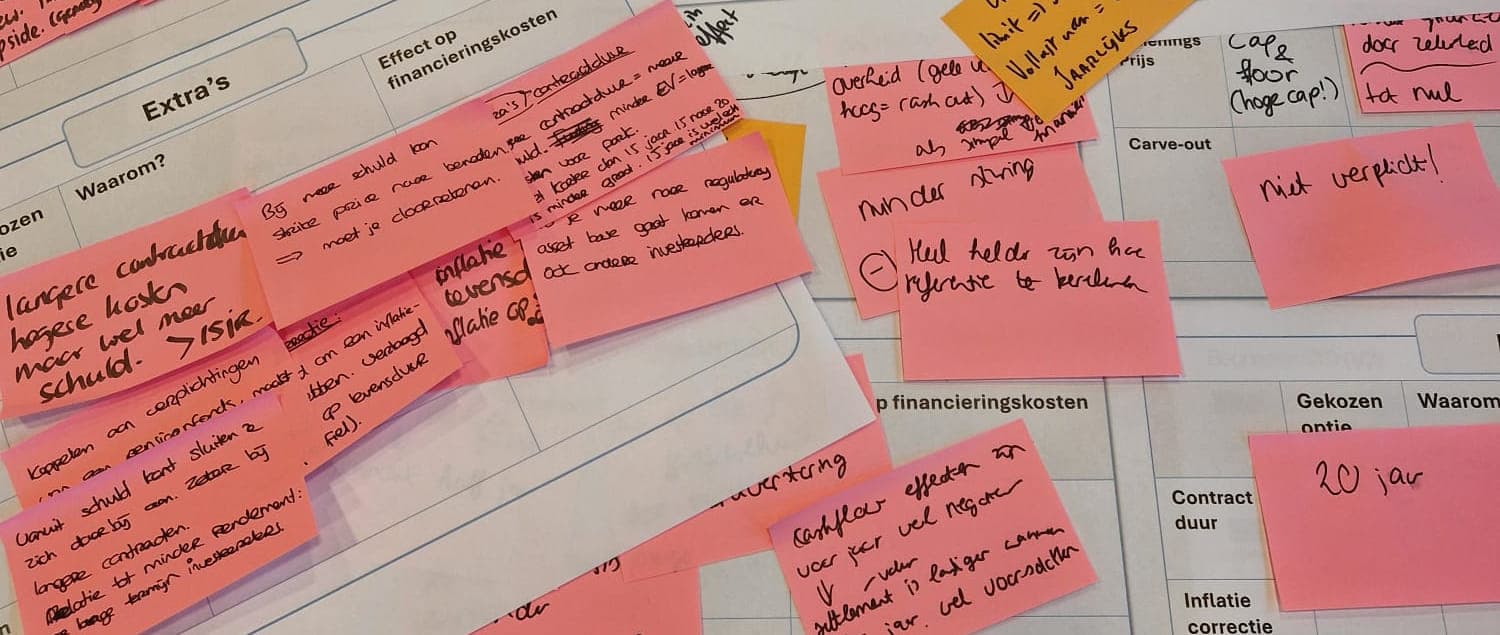

The Financing Table provided the ministry with valuable insights into how financiers and investors think about topics such as contract duration, inflation adjustments, carve-outs (selling parts outside the contract), and dealing with negative prices.

This session is an example of our consultative Financing Tables. Invest-NL organises Financing Tables to work together with the government and the financial sector to resolve financing bottlenecks and mobilise capital for sectors where the market hesitates.

The outcomes of the session will be incorporated into the design of a CfD for offshore wind energy. It is expected that a tender will be issued for this in 2027. In this way, we collaborate on an instrument that aligns with practical realities and supports a financeable energy transition.

Myrthe van Dalen

business development manager