Biobased & Circular economy

Making a new market for biobased plastic possible

Approach

Direct investmentPartner

ABN AMRO Bank, ASN Bank, ING Bank and RabobankDate

March 7, 2023Reading time

9 minutesA world without fossil-based plastic may sound like a dream. However, it is realistic. Invest-NL puts its credo ‘We make what seems unfinancable, financeable’ into practice with the funding for a ‘first of a kind’ FDCA (furandicarboxylic acid) plant by Avantium. Tom van Aken (CEO of Avantium), Marjella de Vries (senior investment manager at Invest-NL), and Elwin van Rooijen (investment manager at Invest-NL) discuss creating an entirely new market.

A giant step

In the modern world, plastic materials play a prominent role. It is found in food packaging, our phones, laptops, cars, and more. A world without plastics is unthinkable. The challenge is to use less plastic and ensure that plastics are made circular and sustainable based on renewable resources. That would be a huge step towards a sustainable economy. Avantium works on this every day. Tom is proud of the company: “I lead one of the most promising chemical companies in the world, with an amazing team of more than 250 passionate and talented people from over 25 countries. It’s very energizing to work for a company that is highly innovative and at the same time involved in relevant sustainability transitions.”

PEF is made without using a single drop of mineral oil.

Tom van AkenCEO of Avantium

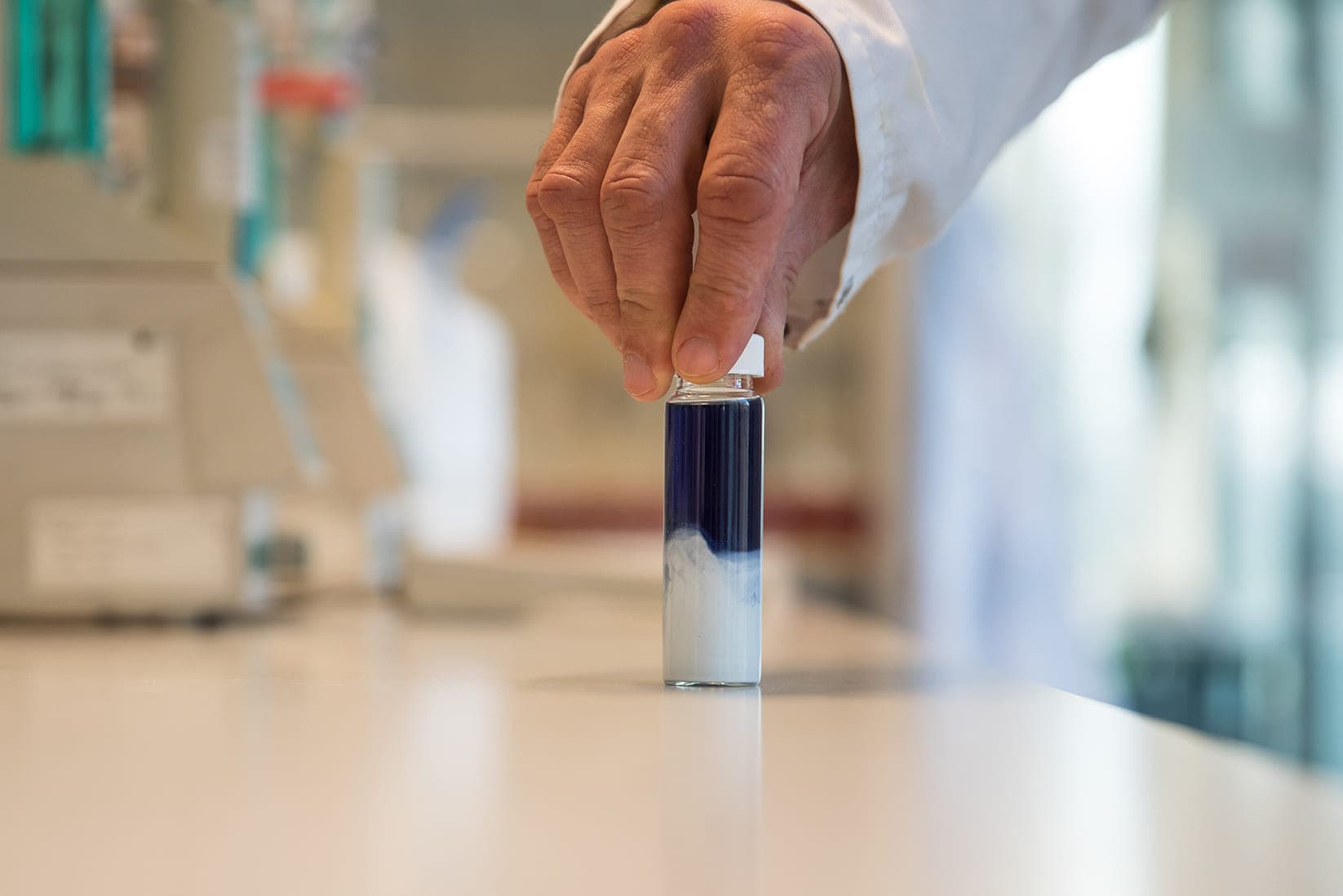

Avantium develops and commercialises innovative technologies to produce chemicals and materials from renewable feedstocks such as plants and CO2 instead of fossil resources like oil and natural gas. Tom: “For example, we produce the new material PEF (polyethylene furanoate) for bottles, packaging, and textiles. PEF is a bio-based alternative to PET (polyethylene terephthalate). PEF is produced without a single drop of oil. We use sugars from plants. We believe we are a frontrunner with our protected technology to produce one of the major materials of the future.” Additionally, the products fit exceptionally well with the circular economy.

This way, PEF can be endlessly recycled, helping to reduce the waste problem. Tests (including accelerated ones) have also shown that PEF decomposes many times faster than PET, so if it unexpectedly ends up in nature, bacteria and fungi will break it down.

Avantium makes an active contribution to a sustainable world through its technologies and products. Tom also links sustainability to business: “The great thing is that we can combine the sustainable aspects with an attractive business case. The business model we use is based on selling technology licenses. This allows us to quickly and efficiently roll out and operate the technology worldwide.”

This first factory in Delfzijl is thus an enabler for fossil-free plastic production on a global scale.

Marjella de VriesSenior Investment Manager at Invest-NL

Investment Round

Invest-NL has committed a loan of €30 million to Avantium. The loan is part of a three-year debt financing of €90 million provided by a consortium of lenders, besides Invest-NL, consisting of the four Dutch banks ABN AMRO Bank, ASN Bank, ING Bank and Rabobank. Each bank has committed €15 million in the form of a bank loan. Tom adds: “Thanks to the financing, we were able to make the investment decision for our FDCA Flagship Plant in Delfzijl. Construction of this plant is now in full swing. It means that there will soon be a factory that produces FDCA, the building block for PEF. This allows us to create a whole new market. It is a huge milestone for the bio-based economy and the world of circular plastics, and I think we can be proud that this technology was developed in the Netherlands and is being used on a commercial scale for the first time. Marjella adds: “By demonstrating with this factory that it can be produced on a commercial scale, Avantium is paving the way for the large-scale introduction of PEF. We expect that, following this factory, several more plants will be built under Avantium’s licence with higher capacity. “This first factory in Delfzijl is therefore an ‘enabler’ for fossil-free plastic production on a global scale.”

The problem with this type of ‘first of a kind’ factories is that they are normally difficult to finance due to the combination of technological and commercial risks. Invest-NL has played a crucial role within the consortium. The Dutch banks, together with Invest-NL, pooled their efforts to make the transaction happen. Tom: “The collaboration between the banks and Invest-NL demonstrates how a combined effort can meet the capital needs of an innovative and sustainable company like Avantium. With the role Invest-NL took in the process, they literally put their credo ‘we make unfinancible projects financable’ into practice. Marjella: “Financing a factory that produces a new material such as PEF is not common and falls outside the usual frameworks of financiers. Therefore, its financing really required custom solutions. All involved parties had to be flexible and creative. Our contribution to structuring this deal and the relatively large ticket (€30 million) has made this difficult-to-finance project feasible. ‘That is something to be proud of.’

Time to build a strong relationship

Avantium had already initiated contact with Invest-NL in January 2019, at a time when they were still in the startup phase. Tom: “Since that first contact, there has been ongoing dialogue. For example, a delegation from Invest-NL visited our Technology & Markets Day in 2019, where we announced our plan to build the world’s first commercial FDCA production facility. Also, in 2019, an Invest-NL delegation visited our FDCA pilot plant in Geleen. Over the past few years, discussions have intensified, and together with Marjella and Elwin, we worked towards the financing that was finalised in 2021.”

I think it's very impressive how the people of Invest-NL in a short period have been able to understand thoroughly our organisation, our products, and our sector.

Tom van AkenCEO of Avantium

Elwin speaks from the perspective of Invest-NL: “The introduction of a new type of plastic happens rarely, which makes Avantium so special. Besides its impact potential, Avantium has created the conditions to be successful as a company; Avantium has a highly professional team and has shown great perseverance under challenging circumstances with a consistent narrative. Furthermore, Avantium surrounds itself with the right partners: from stakeholders to financiers to 'blue chip' companies such as LVMH, Carlsberg, and Henkel. Because of this, we believe that Avantium has what it takes to realise its ambitions and thereby put the Netherlands on the map as a leader in sustainability and innovation.”

Tom is impressed by the development of Invest-NL: “What surprises me most is that the organisation is quickly evolving into a party that also wants to take the lead in making difficult-to-finance projects bankable; this is also much needed to accelerate the energy and raw material transition. My impression is that Invest-NL is a very professional organisation, with enthusiastic and driven employees. I find it very impressive how the people of Invest-NL have been able to thoroughly understand our organisation, our products, and sector in a short amount of time.”

Creating Impact Together

The FDCA Flagship plant of Avantium becomes the world's first factory to produce FDCA on a commercial scale, with an annual capacity of 5 kiloton. Avantium believes that, beyond generating revenue and profits from product sales, the factory will demonstrate the possibilities of large-scale production and use of PEF to consumers, customers, and partners. This should pave the way for a massive expansion in PEF applications, with a potential total end market of $200 billion per year, which Avantium aims to access by selling licenses to industrial companies worldwide. On 21 February 2023, Avantium announced that such an initial technology license has now been sold to the American company Origin Materials, which will build a factory with a capacity of 100 kiloton.

To ensure that Avantium's strategy is rooted in the broader global agenda, Avantium has aligned its pillars with the SDGs (Sustainable Development Goals). Tom: “We support the SDGs through our technologies, our operations, our people, and our leadership. We have set ambitious goals in this regard, which are outlined in our Sustainability Plan Chain Reaction 2030. Avantium will report annually on predefined impact and ESG (Environmental, Social, and Governance) KPIs.” Marjella: “Invest-NL acts as a ‘sustainability coordinator’ on behalf of the banks. This means that we, together with Avantium, have established a number of objectives aligned with the SDGs.

As part of our role, we commissioned an ESG assessment from Ecovadis on Avantium. Avantium has successfully passed this with flying colours: with a gold rating, Avantium is in the top 5% of Ecovadis’ database.”

Work is also underway on a possible further collaboration. Marjella: “In addition to financing the factory in Delfzijl, our colleagues from Business Development are also working with Avantium. This has led to publications on bioplastics and ‘true pricing’ of plastics, among others. Furthermore, besides Avantium Renewable Polymers (the entity behind the FDCA factory), Avantium is involved in several other innovative and sustainable activities that could be the basis for future cooperation.”

What is needed: a combination of a sense of urgency, political will and courage to change much faster.

Tom van AkenCEO of Avantium

Future

Elwin also looks further ahead: “It would be very nice if Avantium's technology could be scaled up quickly and used as soon as possible to produce fossil-free plastics. Additionally, we at Invest-NL hope to invest in even more great companies like Avantium, so that we can continue to accelerate the climate transition.”

Tom adds a personal note: “I hope that in 10 years we are fully in the transition of phasing out the use of fossil raw materials and that it has become normal to consider this in all aspects of life: your own energy consumption, generating renewable energy, food, transportation, clothing, housing, everything! In industry, I expect the global players to be clean-tech companies instead of oil and gas companies. What is needed: a combination of a sense of urgency, political will, and courage to change much faster, and for us to give the companies driving these transitions the space to innovate, scale up, and expand.”

Questions about this investment? Elwin is happy to help!

Elwin van Rooijen

sr. investment manager

BLOCK VIEW OTHER STORIES

ADD MORE